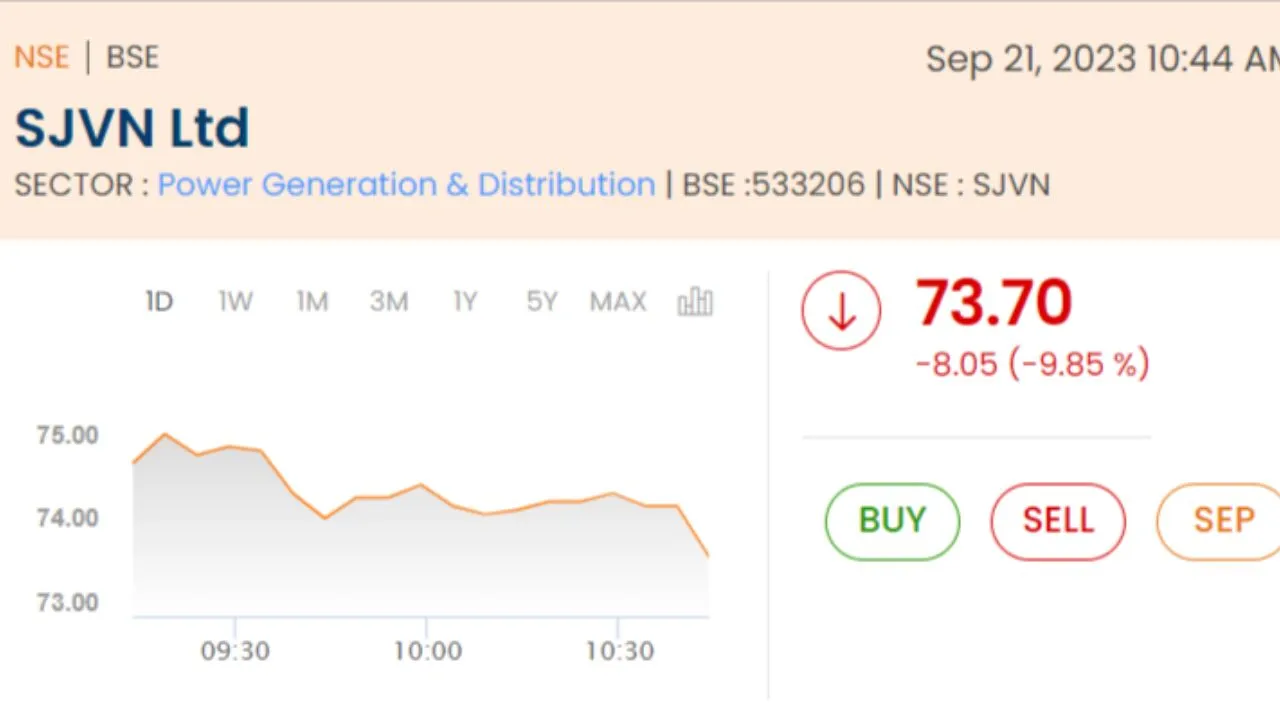

SJVN Shares Drop 10%: In a move that blended the financial exchange waters, state-run SJVN saw a huge tumble of 10% in its portion value during Thursday’s exchanging meeting. The reason for this disturbance? The organization’s advertiser started a proposal available to be purchased (OFS), meaning to strip up to 9,66,72,962 value shares more than a two-day time span, with the procedures beginning on the day being referred to.

The floor cost for this interesting monetary move was set at an apparently humble Rs 69 for every offer, connoting a significant 15.59% markdown from SJVN’s end cost on the first Wednesday, which remained at Rs 81.75 per share.

SJVN Offer available to be purchased (OFS): Stock Plunges 10% as Floor Cost at Rs 69 Reflects 16% Markdown

The vender, for this situation, is, in all honesty, the Leader of India, acting through the regarded Service of Force, Administration of India. The reasoning behind this OFS adventure is attached in the basic to line up with least open shareholding standards, as the public authority holds a telling 86.77% stake in the organization.

The financial exchange, ever-delicate to such turns of events, quickly answered with SJVN’s portions diving by 10.05% to contact a nadir at Rs 73.53 on the Bombay Stock Trade (BSE).

To dive further into the mechanics of this OFS, the base deal is a 2.46% stake of the complete gave and settled up capital of SJVN. Nonetheless, in case of an oversubscription, the organization has communicated its goal to get an extra reserve of up to 9,66,72,961 offers, in this manner raising its OFS commitment to 4.92% of the complete gave and settled up value share capital.

For retail financial backers, an enticing suggestion arises, with 10% of the OFS being held for distribution to this classification, dependent upon the receipt of legitimate offers. All the while, common assets and insurance agency end up qualified for at least 25% of the deal shares. SJVN Shares Drop 10%

SJVN Shares Drop 10%

A nuanced part of this offering concerns qualified workers who might submit offers for shares adding up to Rs 5 lakh. It’s essential, in any case, that such offers will at first be assessed for assignment up to Rs 2 lakh. Any excess piece, if undersubscribed, will be disseminated relatively, gave it doesn’t surpass the Rs 5 lakh edge for every worker.

The present offering honor only reaches out to non-retail financial backers. Intriguingly, during the bid situation, these financial backers have the choice to communicate their eagerness to convey forward any unallocated offers to the next day, with assignment to be considered for the withdrew segment inside the retail classification. SJVN Shares Drop 10%

This intricate monetary expressive dance is set to unfurl during exchanging hours a devoted window of the stock trades, starting at 9:15 am. As a significant detail, Friday’s procedures will solely engage offers from retail financial backers, introducing one more part in the fascinating adventure of SJVN’s value shares. (SJVN Offer available to be purchased (OFS): Stock Plunges 10% as Floor Cost at Rs 69 Reflects 16% Markdown) SJVN Shares Drop 10%

Robert Kiyosaki’s Last WARNING : The Biggest Crash in World History 2023