Bank of England: The pound rose sharply and then fell after the announcement !

Bank of England: British bonds rose after the Bank of Britain said it would make a transitory acquisition of long haul English bonds on Wednesday and defer an arranged obligation deal.

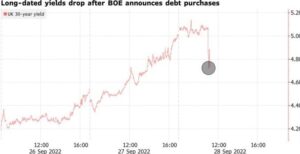

The 30-year yield fell 26 premise focuses to 4.72% after beforehand rising 15 premise focuses to its most significant level starting around 1998. The pound bobbed momentarily prior to withdrawing once more.

The pound bounced up forcefully, yet later lost every one of the additions accomplished thanks to the distribution of the controller’s actions.

The following is the full text of the National Bank’s assertion:

“As the Lead representative said in a proclamation on Monday, the Bank is following improvements in the monetary business sectors intently considering the critical revaluation of UK and worldwide monetary resources.

This revaluation has become more critical over the course of the past day – and it particularly influences the drawn out open obligation of the UK. On the off chance that the brokenness in this market proceeds or declines, there will be a huge gamble to the UK’s monetary dependability, an outlandish fixing of supporting circumstances and a decrease in the inflow of credit assets into the genuine economy.

In accordance with its evenhanded of monetary security, the Bank of Britain stands prepared to reestablish market capability and decrease any dangers from virus to credit conditions for UK families and organizations. Bank of England

Bank of England

To this end, the Bank will do impermanent acquisition of long haul UK government bonds from 28 September. The point of these buys will be to reestablish precise economic situations. Buys will be made in any sum important to accomplish the predetermined objective. The activity will be completely repaid by Her Highness’ Depository.

These buys will be totally restricted in time. They are intended to tackle a particular issue in the drawn out government security market. Sell-offs will run from today until October fourteenth.

MPC’s yearly objective of £80bn in resource decreases has not changed. Considering current economic situations, the bank’s administration has delayed the initiation of the offer of obligation protections, which were because of start one week from now. The primary exchanges for the offer of these protections will happen on October 31 and go on after that.

The bank will before long distribute a market notice illustrating functional subtleties.”